The possible hike in interest rates by the US Federal Reserve and rupee strengthening against dollar led to gold prices per 10 gram fall below the Rs 25,000 mark last week in Ahmedabad. In return, the imports of gold have gone up just ahead of the festive season.According to the latest data, 10.78 metric tonnes (MT) of gold were imported to the state in July this year compared to 3.06MT in the same period in 2014, an increase of 252.29%.

After less than 5MT imports from December 2014 to February 2015, around 22MT gold were imported in March, followed by 13.11MT in April and 5.78MT in May.In June 2015, however, the imports dipped to 1.32 MT, lowest in June in the last six years. But with the prices falling considerably in the international market, the imports picked up in July despite monsoon being considered a lean season for bullion traders and jewellers.

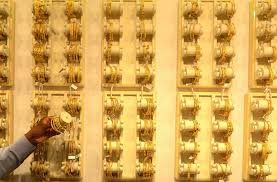

For the first time in four years, the gold prices per 10 gram in Ahmedabad fell below the Rs 25,000 mark on August 6. It was trading at Rs 24,870 (spot pricing).

An international journal for the bullion industry recently said that in the next six to 12 months, gold prices in India could fall below Rs 20,000.

This would mark a slide of nearly 20% from current levels and a drop of close to 50% from its all-time high of Rs 35,000 seen two years ago. In the international market, gold continued to trade below $1100 per ounce last week.

“The fall in prices can be attributed to anticipation of a possible interest rate hike by the US Federal Reserve in coming months. Adding to the anticipation, the strengthening dollar and fall in demand for gold in international market has further brought down the prices below the psychological Rs 25,000 mark,” said Chirag Thakkar, director, Amrapali Industries.

“We expect the prices to breach the Rs 23,000 mark by September,” said Piyush M Bhansali, president, Shree Choksi Mahajan, Manek Chowk.According to rating agency, India Ratings and Research, the prices in India may even dip to Rs 20,500, a level last seen about five years ago, in case of a rate hike by the US Federal Reserve later this year.

ref: timesofindia